how to claim my tax back

A refund will not be made until these materials are unused when left behind in the country. What about the cost of my mask.

|

| Tax Tip How To Claim Work Related Calls On Your Tax Return Tax Return Tax Refund Tax Time |

How Do I Claim My Tax Back When I Leave Uk.

. In order to find out if you are owed money from Revenue you will need to request your Statement of Liability. On the government website you can download the form. Make sure all information is correct before submitting the request. Added January 13 2022 A4.

Apply using our online form or request a form by email or post. The quickest easiest and most convenient way to submit your claim for tax back is online using PAYE Services in myAccount which is accessible on. In order to qualify for a refund with individual purchases of more than Canadian 50 US40 you must spend at least Canadian 200 US161. To lodge online you will need to link your myGov account to the ATO.

The same goes for any antigen tests you may have taken at home - you will not be able to claim tax relief on the cost of these. Use this service to see how. 20 40 or 45. This happens when the amount of tax paid by a taxpayer is more than hisher actual tax liability for that particular FY.

Claim a tax refund - GOVUK Claim a tax refund You may be able to get a tax refund rebate if youve paid too much tax. I WANT MY TAX BACK. There is no better time to claim tax back you are owed from Revenue. Our team will be delighted to help you.

Details If youve paid too much tax and want to claim back the over-payment use form R38. You will only pay tax if you earn above the tax threshhold in the tax year which is currently R73650 per annum. One eligibility requirement for the 2021 Recovery Rebate Credit is that you must have a valid SSN or claim a dependent who has. 10000 miles of business travel at 45p per mile 4500.

A completed Form P50. Do I need to have an SSN to claim the credit. Income tax refund is a process by which the Income Tax Department returns any excess tax paid by a taxpayer during a particular financial year FY. Social Security Number Requirement.

The Average German Tax Refund is 1020 GET YOURS NOW. My Tax Refund Choose the option below that works the best for you. Ready to claim a tax refund from Canada. Visit eFiling to register and submit your return online.

Can I Claim Tax Back At Airport Canada. Ad MyExpatTaxes Making sure you always get a maximum tax refund. Please read our blog on Returns Rebates and Refunds to help understand things better. 20 of 4500 900 tax relief.

If your tax refund exceeds 500 CAD you will be charged 125 percent plus a handling fee. Claiming tax back on travel expenses is only allowed if you have to go outside Ireland due to a medical condition for which no treatment is available in Ireland. We will do the rest to lodge your tax return. The rate of mileage tax relief you can claim is based on the rate of income tax you pay.

If you paid tax and earned less than this amount in the year you will be eligible to claim it back. We Made US Expat Tax Filing Easy. Method 1 Taking Deductions and Credits Download Article 1 Report major life changes. Income Tax Return Form 12 if you are registered for Pay As You Earn PAYE Income Tax Return Form 11 if you are self employed.

In the event you leave the UK HMRC asks you to complete form P85 Leaving the UK and Getting Refunds for Your Tax. We Made US Expat Tax Filing Easy. If you are not e-enabled you will need to send the following to your Revenue office. Create your myGov account and link it to the ATO Due dates for your tax return If youre lodging your own tax return you need to lodge it by 31 October each year.

How can I get my tax back. Plus if you have any questions about the German tax you can contact our Live Chat team anytime 247. Or if you have the time on your hands or you just prefer it as an option you can visit your nearest SARS branch of which there are many scattered everywhere. As of now Revenue have yet to decide.

There is a fixed cost of 6250 if your refund is less than 500 plus handling fee. You can also use this form to authorise a representative to get the payment on your behalf. Back all or part of the payment you received based on the information reported on your 2021 tax return. The excess tax can be claimed as an income tax refund under Section 237 of the Income Tax Act.

Log into PAYE Services within myAccount and select Claim unemployment repayment. If you lodge your tax return online using myTax we will pre-fill most of this information for you. Getting married having a child or buying a house are examples of positive life. You can claim your tax back by either eFiling which is the quickest and easiest way to submit your return.

A person can claim the refund of the excess tax paiddeducted during a financial year by filing his or her income tax returns for that year. APPLY NOW Who Can Claim. Ad MyExpatTaxes Making sure you always get a maximum tax refund. Everyone can claim tax back.

CLAIM NOW Apply Today. In most countries you must file a return to claim tax back. Purchases you buy should not be worn or used. Basic rate of income tax paid at 20.

Claim my tax back claim my tax back claim my tax back online claim my tax back hmrc claim my tax back working from home claim my tax back on ppi rev. Sundara Rajan TK CA and Partner at DVS Advisors LLP says A person can file hisher income tax return either using online method only for ITR-1 or ITR-4 form or using JSON utility. You can use the form to claim your claim. If youve paid too much tax Revenue will refund you either directly into your bank account if youve put your details online or by cheque.

Use our free tax refund calculator for Canada today to find out how much Canadian tax you are due back.

|

| Pin On Tips And Tricks |

|

| Trying To Discover How To Claim The Tax Back On Your Global Blue Shopping Read Below To Find Out Exactly Where All The Tax Heathrow Tax Refund How To Find Out |

|

| Claim Your Tax Return Online Bank Account Tax Refund Banking App |

|

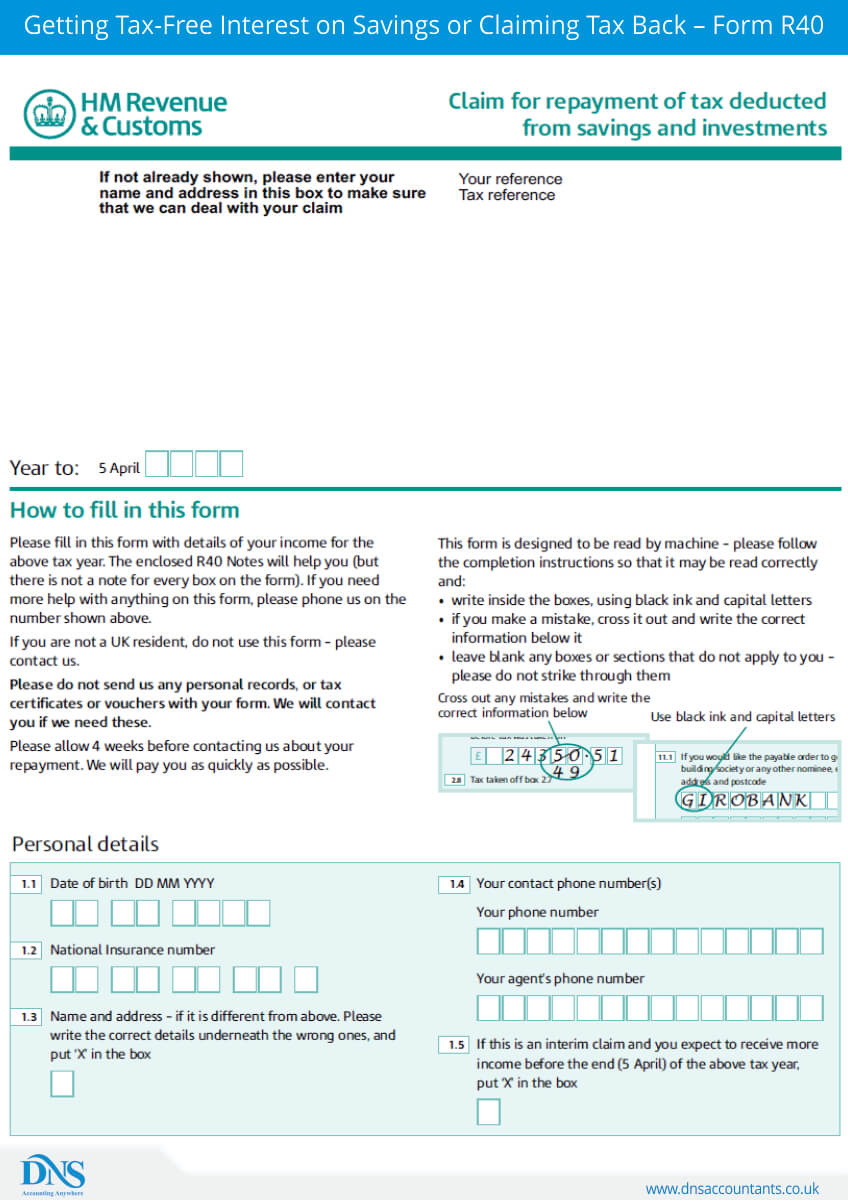

| Getting Tax Free Interest On Savings Or Claiming Tax Back Form R40 Dns Accountants |

|

| How Do I Claim Tax Back Low Incomes Tax Reform Group |

Posting Komentar untuk "how to claim my tax back"